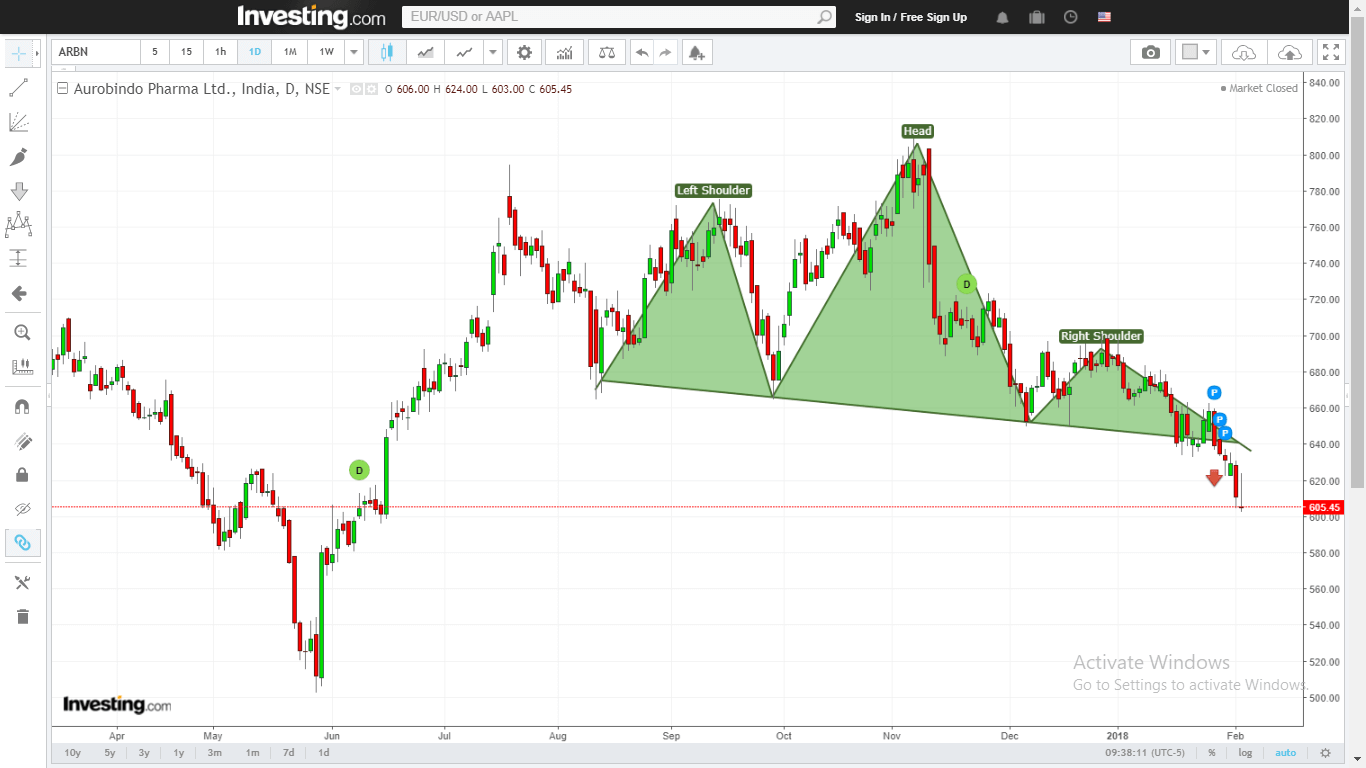

Auropharma Forms a Head and Shoulder Pattern . Selling opportunity for bears:

A falling head and shoulder pattern is a much reliable pattern as it occurs in a prevailing falling trend.

Here is the list of technical factors which reflects the bearish move is underway:

- On weekly charts , the stock price has formed a Double Top reversal pattern which breaks below 660 levels .

- On daily charts a head and shoulder pattern neck line breaks below 635 levels .

- Weekly MACD and Daily MACD both showing sell signals. ADX indicator also showing strength for sellers.

- Stock price is trading below its long term average of 200 day SMA and EMA on both daily and weekly charts.

- Put call ratio below 0.5 Also , highest call writers now at 620 levels.

- Open interest positions also suggesting that most of the positions are on shorter side.

- So selling this script is a conclusive result at bounce with a stop loss at 650 closing basis and first target for the position is 577 and then 560 also looks possible.

- Here is the snapshot: