Radiant Cash Management IPO

Radiant Cash Management IPO, Review, Dates and other Important Information

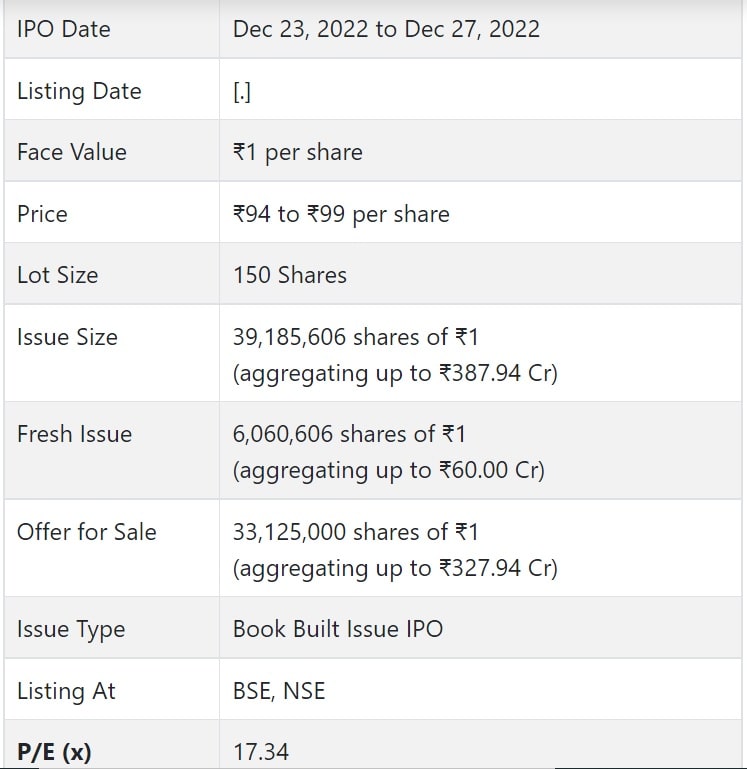

Radiant Cash Management is set to debut in the stock market, with an Initial Public Offering (IPO) scheduled to hit the market on December 23. The IPO will close on December 27 and is expected to raise around 387 crores. The total number of equity shares on offer is 60 crore, of which 35% will be allocated for retail investors, 50% for Qualified Institutional Buyers (QIBs), and 15% for High Net Worth Individuals (HNIs).

The main objective of the IPO is to raise funds for expanding the company’s business operations and for meeting other general corporate purposes. The company offers digital financial products and services, including personal loans, business loans, credit cards, and investment products. Radiant Cash Management has a strong online and offline presence and a wide network of branches and ATMs across the country.

The company has been growing at a fast pace and has registered strong growth in its financials over the last few years. For the financial year that ended March 31, 2019, Radiant Cash Management reported a total income of Rs.2,249 crore, an increase of 43% over the previous year. Its net profit stood at Rs.450 crore, an increase of 54% over the previous year. Axis Capital, ICICI Securities, and SBI Capital Markets manage the IPO. Investors can apply for the IPO through both online and offline channels.

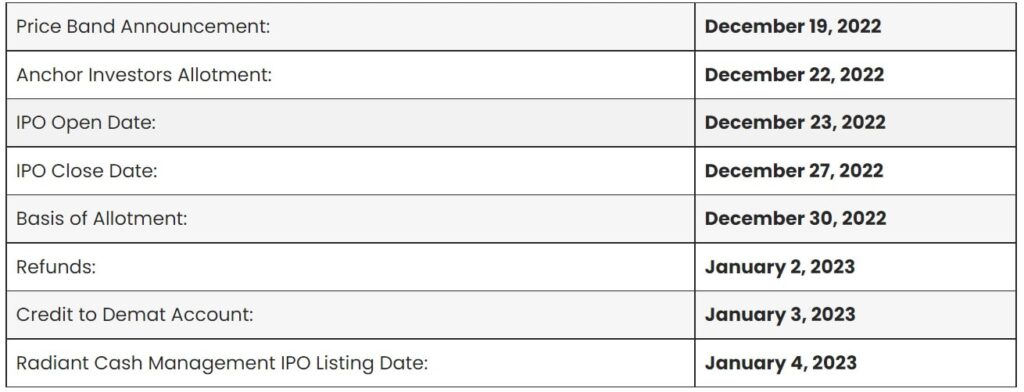

Radiant Cash Management IPO Allotment & Listing Dates

Radiant Cash Management Services Limited is a retail cash management Services Company headquartered in Mumbai, India. It was incorporated in 2005. The company provides services to banks, financial institutions, and organized retail and ecommerce companies. It is the market leader in retail cash management services in India.

The company went public in 2017 and raised Rs. 1,000 crores through its initial public offering (IPO). The IPO was oversubscribed by more than 100 times.

Radiant Cash Management IPO: Growth Potential

Radiant Cash Management, an online payments company, is looking to capitalize on the growth of several key end-user sectors, including ecommerce, organized retail, ecommerce logistics, and financial services. According to the company, these sectors are expected to grow significantly in the coming years, and Radiant Cash Management is well-positioned to take advantage of this growth.

Radiant Cash Management has been growing rapidly since it was founded in 2013. The company processed $17 billion in payments in 2017 and is on track to process over $50 billion in 2018. This growth has been driven by the growth of ecommerce and the shift from traditional retail to online shopping.

Organized retail is another sector expected to grow significantly in the coming years. Radiant Cash Management is well-positioned to take advantage of this growth as well. The company has a strong presence in the organized retail sector and has partnerships with some of the largest retailers in the world.

Ecommerce logistics is another sector expected to grow significantly in the coming years. Radiant Cash Management is well-positioned to take advantage of this growth as well. The company has a strong presence in the ecommerce logistics sector and has partnerships with some of the largest ecommerce companies in the world.

Financial services is another sector expected to grow significantly in the coming years. Radiant Cash Management is well-positioned to take advantage of this growth as well. The company has a strong presence in the financial services sector and has partnerships with some of the largest financial institutions in the world.

Radiant Cash Management is a strong company with a lot of potentials. The company is well-positioned to take advantage of the growth of several key end-user sectors. Investors should keep an eye on this company.

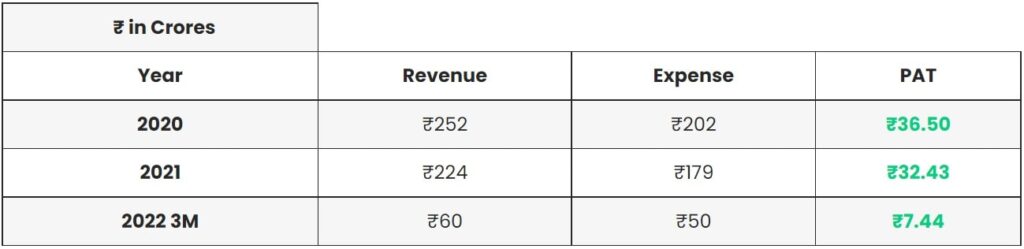

Radiant Cash Management Company Financial Report

The company has a strong management team with extensive experience in the retail cash management industry. The team has successfully implemented several large-scale projects for leading banks and financial institutions in India.

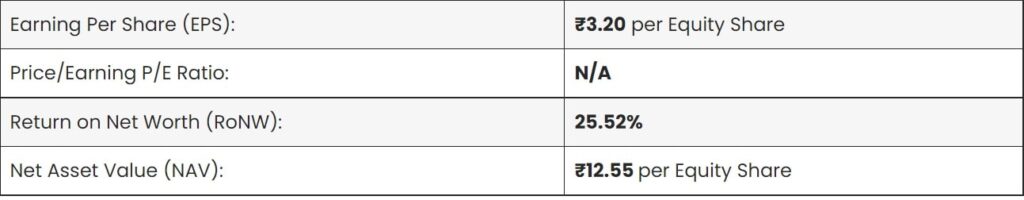

Radiant Cash Management IPO Valuation and Details

The company has a strong focus on customer service. It has a dedicated team of customer service executives available to resolve any queries or issues customers may have.

Radiant Cash Management Review:

- The Radiant Cash Management IPO is a main-board IPO. They are looking to raise ₹387 crores via the IPO. The issue is priced at ₹94 to ₹99 per equity share. The IPO is to be listed on the BSE & NSE.

- The company plans to use the IPO proceeds to repay debt and for general corporate purposes.

- Radiant Cash Management Limited is a non-banking financial company (NBFC) registered with the Reserve Bank of India (RBI). The company is engaged in providing cash management solutions and other value-added services.

- The company has a network of over 5,000 ATMs and provides cash management services to over 500 banks and financial institutions.

- The company was founded in 2009 and is headquartered in Mumbai, India.

- The IPO is scheduled to open on March 26, 2019, and close on March 28, 2019.

Radiant Cash Management IPO: Risks

- Radiant Cash Management is a Mumbai-based startup providing businesses with cash management solutions. The company is highly dependent on the banking sector in India to generate revenues, and any adverse development to Indian banks that affects their utilization of and demand for cash management services could hurt their business.

- The Indian banking sector faces several challenges, including asset quality issues, capital constraints, and slowing loan growth. These challenges are expected to continue in the near term and could adversely affect the demand for Radiant’s services.

- In addition, the Indian government has recently implemented several reforms that could impact the banking sector. For example, the government has introduced the Goods and Services Tax (GST), a new indirect tax that has replaced several existing taxes. The GST is expected to hurt the profitability of banks in India.

- The government has also announced its intention to recapitalize public sector banks. The recapitalization is expected to be funded through a combination of budgetary support and the issuance of bonds. The bonds will be backed by the government’s equity stake in the banks.

- The government’s decision to recapitalize public sector banks is expected to positively impact the banking sector in the long run. However, it could lead to increased competition for Radiant’s services in the short term.

- Radiant Cash Management is a relatively new company with a limited operating history. As a result, the company is subject to several risks, including the risk that its business model may not be successful, the risk that its technology may not be able to scale, and the risk that it may not be able to compete effectively against larger and more established companies.

- The company’s IPO is also subject to several risks, including the risk that the shares may not be listed on a stock exchange, the risk that the shares may not be traded, and the risk that the shares may not be liquid.

- Investors should carefully consider these risks before investing in Radiant Cash Management’s IPO.

Company Address

Radiant Cash Management Services Limited

28, Vijayaraghava Road,

T. Nagar, Chennai 600 017,

Tamil Nadu, India

Phone: +91 044 4904 4904

Email: [email protected]

Website: https://radiantcashservices.com/

One thought on “Radiant Cash Management IPO”