A Strategy Ahead Key Results Of Reliance Industries. An Iron Butterfly.

After reading the technical s of Reliance Industries I came to following conclusions of which the list is mentioned below:

1. Deliverable quantity in the equity markets for the last week or so is quite impressive which is above 50% on an average basis , which reflects the trend becoming stronger for more upside potential.

2.But some concerns in short term horizon as future players were looking to liquidate their longs at the top range of the stock around 950-960 levels and we may see continuity of the liquidation process in the coming days as well.

3. Option chain analysis reflects that the put call ratio favoring the call writers as it is standing at 0.47 approx, also option chain suggest the range at 920 on the lower side and 960 on the higher side.

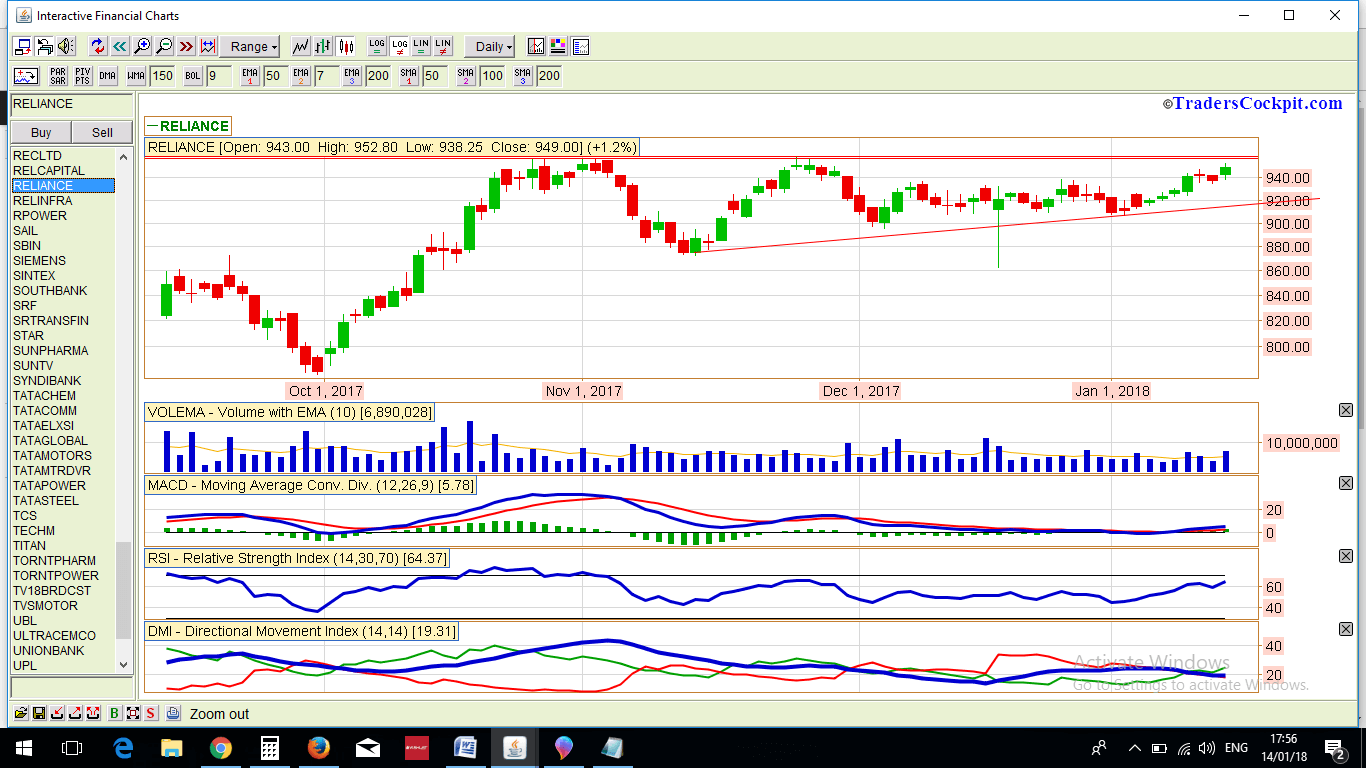

4. Now lets discuss the Technical ground , first on monthly wise stock trading at 940++ after giving a breakout above 860 levels in October series . On Weekly basis , the stock price is consolidating between 875 to 960 levels for the 12 – 14 weeks which signifies that now the stock price may be getting ready for the breakout. On Daily charts the stock is forming a descending triangle formation with higher bottoms but with similar tops. Indicator like ADX line on daily charts coming down as the stock price moving higher which is a significant sign of weakness of the trend.

So on the above mentioned conclusion we are anticipating that the continuity of the bull trend will remain intact in the long term run but for the coming week we can see a bit of of profit taking before the outcome of the result .

So we are suggesting an Iron Butterfly , which is a combination of short put spread and short call spread with the spreads converging at ATM call and put options generally.

Here is the strategy: CMP : 946 INR

LEG 1: BUY PE STRIKE PRICE 920 AT 10: AND SELL 940 PE AT 18 APPROX

LEG 2: BUY CE STRIKE PRICE 960 AT 18 AND SELL 940 CE AT 27 APPROX:

MAXIMUM LOSS INCUR IS 4 POINTS MULTIPLIED BY THE LOT SIZE WHICH IS RS 4000.

MAXIMUM PROFIT POTENTIAL IS AT 16 POINTS MULTIPLIED BY THE LOT SIZE WHICH IS RS 16000.

SO THE RISK REWARD RATIO IS QUITE FAVORABLE UP TO 1;4 RATIO.